Blackened Soul wrote:

i think we’d/ I’d be more interested in playing out if there was a change in the scene and the venues.. I was a bit disappointed actually when everything opened up and it was just the same tired people playing the same shitholes… unless you are talking about the bigger venues and touring bands.. but even that by accounts is getting close to cost prohibitive… there needs a change…. Not sure what that is though… I just know things are broken.

Private equity is buying up rental properties, nursing homes, drug companies, and.... music.

https://www.nytimes.com/2024/03/18/opin ... otify.html

"Does that song on your phone or on the radio or in the movie theater sound familiar? Private equity — the industry responsible for bankrupting companies,

slashing jobs and raising the mortality rates at the nursing homes it acquires — is making money by gobbling up the rights for old hits and pumping them back

into our present. The result is a markedly blander music scene, as financiers cannibalize the past at the expense of the future and make it even harder for us

to build those new artists whose contributions will enrich our entire culture."

"Private equity firms have poured billions of dollars into music, believing it to be a source of growing and reliable income. Investors spent $12 billion on

music rights in just 2021 — more than in the entire decade before the pandemic. Though it is like pocket change for an industry with $2.59 trillion in

uninvested assets, the investments were welcomed by music veterans as a sign of confidence for an industry still in a streaming-led rebound from a bleak

decade and a half. The frothy mood, combined with a Covid-related loss of touring revenue and concerns about tax increases, made it attractive for many

artists, including Stevie Nicks and Shakira, to sell their catalogs, some for hundreds of millions of dollars.

"How widespread is Wall Street’s takeover? The next time you listen to Katy Perry’s “Firework,” Justin Timberlake’s “Can’t Stop the Feeling” and Bruce

Springsteen’s “Born to Run” on Spotify or Apple Music, you are lining the pockets of the private investment firms Carlyle, Blackstone and Eldridge. A piece of

the royalties from Luis Fonsi’s “Despacito” goes to Apollo. As for Rod Stewart’s “Do Ya Think I’m Sexy” — hey, whoever turns you on, but it’s money in the till

for HPS Investment Partners.

"Like the major Hollywood studios that keep pumping out movies tied to already popular products, music’s new overlords are milking their acquisitions by

building extended multimedia universes around songs, many of which were hits in the Cold War — think concerts starring holographic versions of long-dead

musicians, TV tie-ins and splashy celebrity biopics. As the big money muscles these aging ditties back to our cultural consciousness, it leaves artists on the

lower rungs left to fight over algorithmic scraps, with the music streaming giant Spotify recently eliminating payouts for songs with fewer than

1,000 annual streams.

"The grim logic that shuttered the big-box store chain Toys “R” Us and toppled the media brand Vice is also taking hold of our music. Historically, record labels

and music publishers could use the royalties from their older hits to underwrite risky bets on unproven talent. But why “would you spend your time trying to

create something new at the expense of your catalog?” asked Merck Mercuriadis, the former manager of Beyoncé and Elton John who founded Hipgnosis."

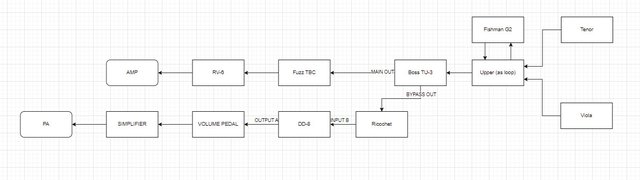

and I think for that, I'll build a riser into the board that lets me mount the power brick underneath and then there's space for another pedal up top.

and I think for that, I'll build a riser into the board that lets me mount the power brick underneath and then there's space for another pedal up top.